Bank of Canada highest rate hike in 22 years.

The future of cryptocurrency in the US hangs in the balance.

Bank of Canada highest rate hike in 22 years.

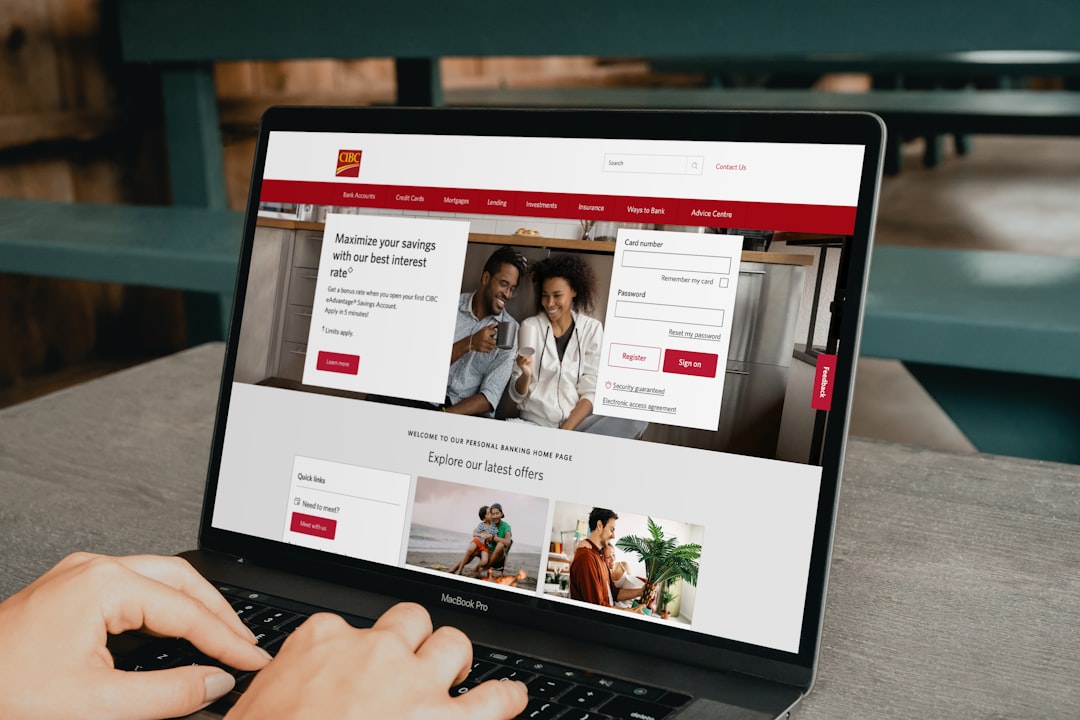

The Bank of Canada raised its key interest rate by 0.25 percentage points on Wednesday, bringing it to 4.75 percent, the highest level in 22 years. The move was the central bank's ninth consecutive rate hike and comes as it tries to bring inflation under control.

Inflation in Canada has been running well above the Bank of Canada's target of 2 percent, reaching 6.8 percent in April. The central bank has said it expects inflation to peak at 8 percent in the coming months before starting to decline.

The Bank of Canada's rate hike is likely to have a significant impact on the Canadian economy. It will make it more expensive for businesses to borrow money, which could lead to slower economic growth. It will also make it more expensive for consumers to borrow money, which could dampen spending.

The Bank of Canada is walking a fine line. It needs to raise rates enough to bring inflation under control, but it doesn't want to raise them so much that it causes a recession. The next rate decision by the Bank of Canada is scheduled for July 13.

Here are some additional details from the article:

The Bank of Canada's decision to raise rates was unanimous.

The central bank said it expects to continue raising rates until inflation is back under control.

The Bank of Canada also said it is prepared to use other tools, such as quantitative easing, to bring inflation down.

The Canadian dollar rose sharply after the Bank of Canada's announcement.

The stock market also rose in reaction to the rate hike.

The Bank of Canada's rate hike is a sign that the central bank is serious about bringing inflation under control. However, it remains to be seen whether the central bank will be able to do so without causing a recession.

The future of cryptocurrency in the US hangs in the balance.

The future of American cryptocurrency looks bleak as Gary Gensler, the chairman of the Securities and Exchange Commission (SEC), declares war on the industry. Gensler has said that he believes that most cryptocurrencies are securities, and that they should be regulated as such. This could mean the end of Coinbase, the largest cryptocurrency exchange in the United States, as it is not currently registered as a securities exchange.

Gensler's comments have sent shockwaves through the cryptocurrency industry, and have led to a sell-off in the price of Bitcoin and other cryptocurrencies. Some experts believe that Gensler's actions could effectively kill the American cryptocurrency industry, as it would be too difficult and expensive for companies to comply with the SEC's regulations.

Others believe that Gensler's actions are necessary to protect investors from fraud and abuse. They argue that the cryptocurrency industry is rife with scams and that it is important for the SEC to step in and regulate it.

It remains to be seen what the long-term impact of Gensler's actions will be. However, it is clear that he is determined to crack down on the cryptocurrency industry. This could have a major impact on the future of cryptocurrency in the United States.

Here are some additional details from the article:

Gensler has said that he believes that most cryptocurrencies are securities, which are investments that are bought and sold with the expectation of making a profit. Securities are regulated by the SEC to protect investors from fraud and abuse.

Coinbase is not currently registered as a securities exchange, which means that it is not subject to the SEC's regulations. If Gensler is successful in his efforts to regulate cryptocurrency, Coinbase would likely be forced to register as a securities exchange or stop operating in the United States.

The cryptocurrency industry is worth billions of dollars and is growing rapidly. However, it is also a very risky investment and there have been many scams in the industry.

Gensler's actions have been met with mixed reactions from the cryptocurrency community. Some people believe that he is trying to protect investors, while others believe that he is trying to stifle innovation.

The future of cryptocurrency in the United States is uncertain. However, it is clear that Gensler is determined to regulate the industry. This could have a major impact on the future of cryptocurrency in the United States.